Voters have been bombarded with economic statistics showing the economy is growing, the economy is sinking, companies are hiring, companies aren’t hiring, but perhaps the simplest measure of economic growth is the Gross Domestic Product, which is the market value of all officially-recognized final goods and servies produced within a country in a given period. Further GDP per capita is condered an indicator of a country’s standard of living.

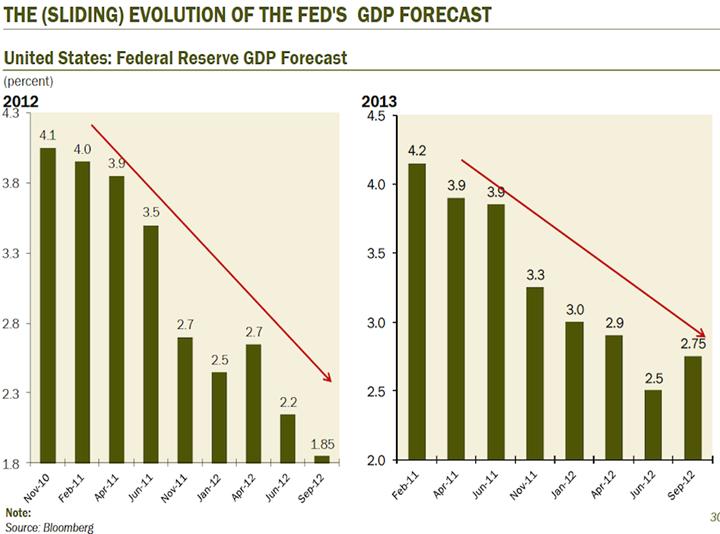

Each quarter, the Federal Reserve revises its prediction for the year’s GDP. If the economy were improving, one would expect that the Fed would revise the GDP higher, right?

Economist David Rosenberg presented at an investment conference in New York on October 10, 2012. He used the following chart to show that the Fed has consistently downgraded predictions of U.S. economic growth over the past two years. Remember, this chart shows predictions, not actual growth, which will not be announced until next year. For example, the November 2010 prediction for 2012’s growth is 4.1%, which would be helpful, but growth predictions for 2012 have been revised this month to 1.85%.

According to a July 2012 article in BusinessWeek:

“Annual economic growth of 2.5 percent to 3 percent is needed to create enough jobs just to keep up with an expanding workforce. Healthier growth of 4 percent or more is needed to reduce the unemployment rate significantly.”

From the charts above, the economy is not predicted to keep pace with population growth in 2012 and is predicted to just barely keep up in 2013 with a projected GDP growth of 2.75%. Of course, this could all be revised as November 2011’s predicted GDP growth was 2.7% and now, it’s predicted to be just 1.85%. In Colorado, the story is much the same as GDP growth has stalled out at 2.2%, which is not even enough to keep up with population growth.

But, this is all just a part of the “recovery”, right? This is usually how it goes, right?

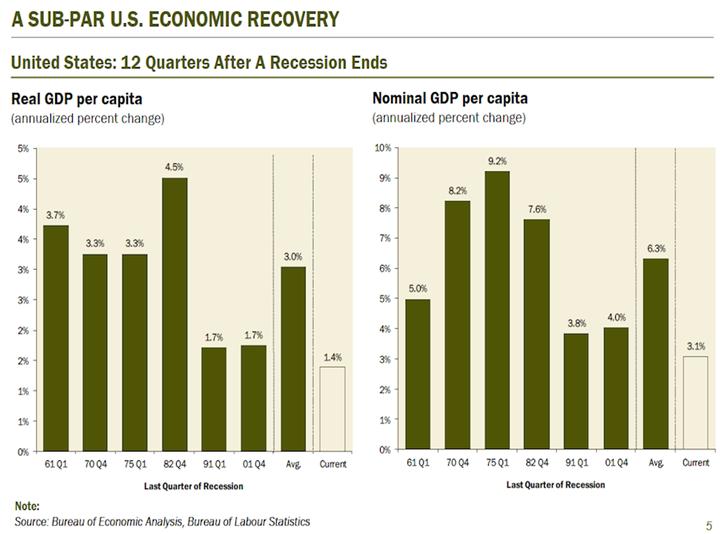

Actually, no. The chart below, also from Rosenberg’s presentation, shows the level of economic growth 12 months after a recession, for each U.S. recession dating back to 1961. The traditional view on economic cycles predicts strong growth coming out of a recession, and that has played out for much of the past half century. Sadly, Obama’s recovery has defied this trend.

Economic growth during Obama’s “recovery” has been less than half that of the average post-recession growth over the past fifty years. Instead of the virtuous cycle of recovery:

Obama’s policies have created a vicious cycle of uncertainty, fear, and anemic growth.