Following the passage of the fiscal cliff deal, President Obama has claimed that the tax hikes were only for the top 2%, yet the liberal Tax Policy Center has identified all the tax brackets that will be affected by the deal. Here’s what Obama had to say about the deal:

“Thanks to the votes of Democrats and Republicans in Congress I will sign a law that raises taxes on the wealthiest 2% of Americans while preventing a middle-class tax hike that could have sent the economy back into recession and obviously had a severe impact on families all across America.”

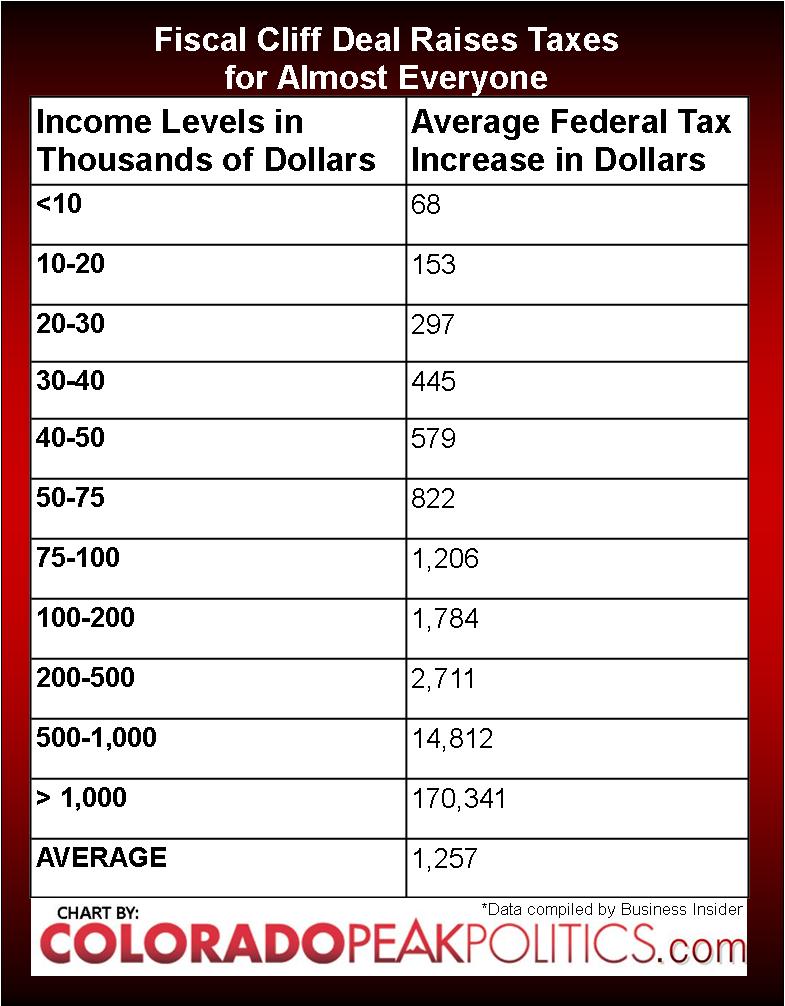

Gosh, Obama’s vision for the fiscal cliff deal reached yesterday sounds like it really benefits the middle class. Unfortunately, the fiscal mess that Obama shoved through Congress is actually a tax increase for 77% of Americans, according to the Tax Policy Center. Business Insider helpfully outlined the tax increases per income bracket (see right).

Gosh, Obama’s vision for the fiscal cliff deal reached yesterday sounds like it really benefits the middle class. Unfortunately, the fiscal mess that Obama shoved through Congress is actually a tax increase for 77% of Americans, according to the Tax Policy Center. Business Insider helpfully outlined the tax increases per income bracket (see right).

According to the 2011 Census American Community Survey, the median income per household in Colorado is $55,387, the median family income in Colorado is $69,110, and the median per capita income in Colorado is $29,804. This means that the average family and household will see $822 more in federal taxes, and the average Coloradan will see nearly a $300 tax increase.

These numbers may not seem terribly onerous; however, when you combine the federal tax increases with the nearly 20% property tax increases in Denver from Referendums 2A/2B and the upcoming taxes associated with Obamacare, this is a huge tax increase on middle class families. Once again, Obama says he’s protecting the middle class, when in reality, the middle class is suffering too. This fiscal cliff deal is simply not a good deal for America, or for most Coloradans.

Bravo to the legislators who stood up to this bill, including Reps. Coffman, Tipton, Lamborn and Gardner and Sen. Bennet. We’ll give credit where credit is due. Sen. Udall and Reps. Degette, Perlmutter, and Polis, wrong vote.

This is not a surprise. The Liberals are bad at math and great at marketing. We could tax tax the "rich" at 100% and it still would not be enough to generate the revenue necessary to support the entitlement programs for the left and defense spending for the right. Thus it falls on the middle class to provide the revenue, since our reprobate politicians are unable and unwilling to cut spending.

That's an interesting point about Bennett.

Bennett is up for re-election. He knew the bill would pass without his "yes" vote. I think he voted "no" so he can go around and tell everyone that just to get re-elected. Thank you Rep. Lamborn for standing firm against these taxes. Now, let's get them all to vote NO on their own salary increase!

REAL BAD DEAL!

Jared Polis voted to screw his constituency? There's a shocker. Polis is all about screwing Boulder and the High Country.