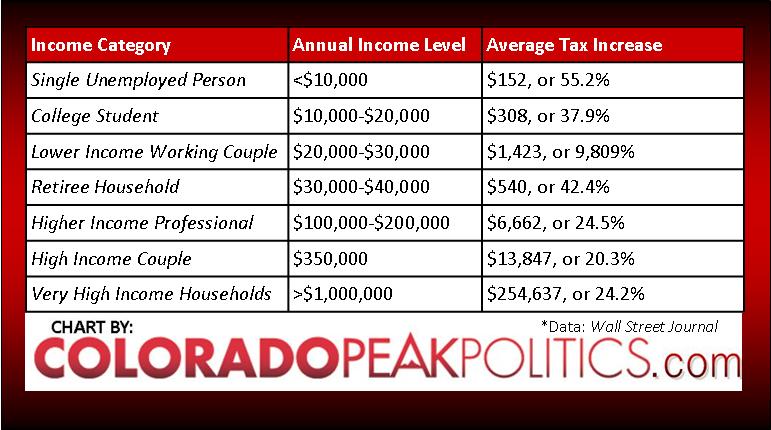

Many Coloradans opened their pay stubs this week to learn that their pay was far less than they had hoped. Wall Street Journal illustrated how new tax rules impacted various levels of income. Here is a handy chart that might help explain the missing money:

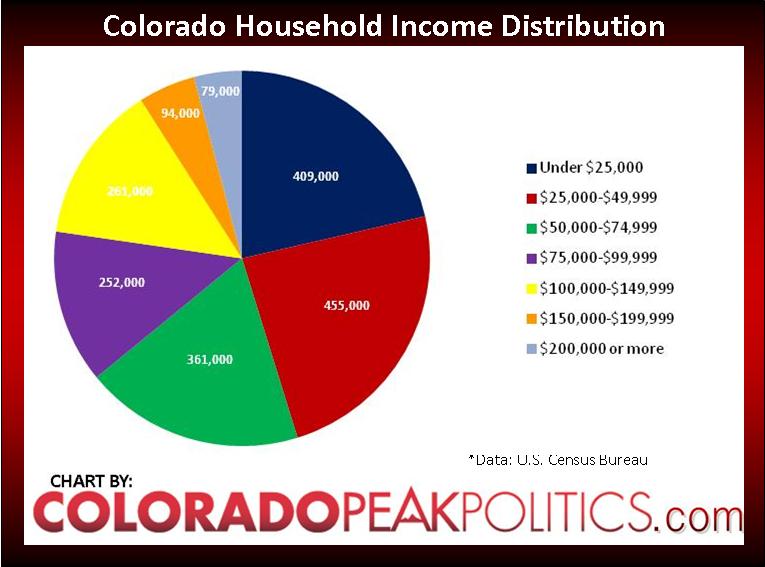

This chart is simply for federal taxes; however, Coloradans might feel the pinch more severely due to recent local tax increases. Below is a chart that shows income distribution in Colorado:

While the categories don’t align exactly, the impact is obvious. Every category in this chart will see a tax increase. Some will see significant increases. For example, according to the Wall Street Journal, households making $100,000 to $200,000 will have $6,662 on average less disposable income each year, or just over $500 less per month. That’s a significant shortfall for nearly 350,000 households, but those households are just a few pieces of the pie. Everyone’s taxes are increasing. And, why? How are we, as a country, spending money? Is the debt and burden placed on Colorado families worth it?