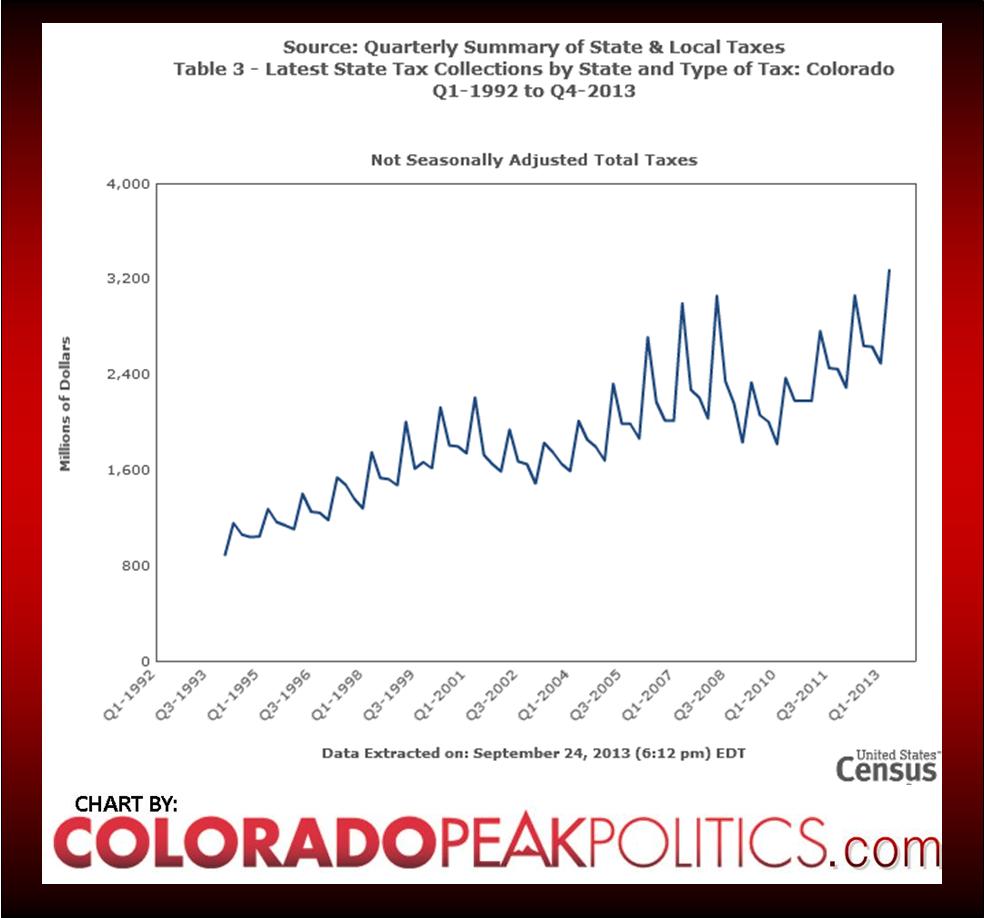

As Coloradans consider whether to vote themselves a billion dollar tax increase to fund union broken promises, the Census published updated numbers showing that Coloradans have never paid so much in state and local taxes as they did in the second quarter of 2013. See the chart below.

Of course, if you’re as skeptical of government data as we are, you would say to yourself, “well, maybe the raw numbers are misleading because Colorado has a larger population now, so of course, the state would collect more in income tax.” Your inner voice would be incorrect.

Looking at the second quarter in 2005, Colorado collected $2,320,000,000 in taxes and had a population that year of 4,861,515, which means that $477.21 per person was collected in 2005. In 2012 (the latest population figures available), the state collected $3,061,000,000 in taxes with a population of 5,187,582, which translates to $590.06 in taxes were collected per person that year. So, the trajectory is that each person is paying more in taxes. We knew you’d ask.

So, here’s the question. Given that there should be economies of scale as the population grows, why is the state collecting more in taxes now than ever before when the state is not yet recovered from the recession? And, an even better question is, why are the proponents of Amendment 66 pushing for a billion dollar tax increase when Coloradans already are paying more in state and local taxes than ever before?

Wow..

Doesn't matter what the taxes are for individually. The issue is very simple: do we want to pay more when the government is already taking our money at an ever increasing rate? I guess liberals would feel better if they kept giving more and more money to the state as long as it's for their pet causes.

the taxing authority grows, grows, grows, grows, grows, grows, grows……………………….

If your data are not in constant dollars, then inflation accounts for about 80% of the increase.

But it still remains that the revenues have increased disproportionately to the population growth. Those increased revenue sources you cite should have resulted in less taxes elsewhere. Or we should be better off for the increased spending. Neither has happened.

What taxes are included? Mineral severance taxes? Tourism taxes? Lodging Taxes? You'll note, for instance, that the graph tracks the last two energy booms quite well, starting around 1999-2007 in the tight sands of the Piceance; dropping when the last bust hit devastating W.CO economies in GarCo and GJ; and then increasing again as the Niobrara came on line. I know, probably not any info you want to share as it may poke a big hole in your argument.