Colorado Democrat U.S. Rep. Ed Perlmutter is about to face a lot more questions about his clear pattern of questionable stock trading.

The now vulnerable congressman is among a list of 44 members of Congress who failed to comply with a law requiring elected officials to report stock trades in a timely manner, Business Insider* reports.

The law in question is known as the Stop Trading on Congressional Knowledge (STOCK) Act which among other provisions mandates a 45 day window for members of Congress to report trades.

Peak has reported on Perlmutter’s trading activities previously, particularly his proclivity for trading stocks that happen to fall under the jurisdiction of a committee on which he sits (more on this later).

In August comments to Business Insider, Perlmutter blamed his accountant for an error, which involved failing to properly disclose two trades by his wife of Alibaba and Berkshire Hathaway stock.

Both transactions that Perlmutter failed to properly report are intriguing for different reasons.

Nancy Perlmutter sold as much as $15,000 in stock in e-commerce company Alibaba Group Holding Limited. The company has ties to the Chinese Communist Party, for which it reportedly helped produce a propaganda app. The disclosure shows that after her sale, on June 14, she retained some shares in the company.

Nancy Perlmutter, a public school teacher who has spoken openly about her friendship with first lady Jill Biden, also bought up to $15,000 worth of stock in Berkshire Hathaway, billionaire Warren Buffett’s holding company, on June 16.

Perlmutter picked up Alibaba shares following Biden’s election in November, and again in May before deciding to unload some of their position in July at a likely loss.

Alibaba shares have been in a tailspin ever since the Chinese Communist Party and President Xi escalated their crackdown on businesses, including Alibaba founder Jack Ma who only reappeared in October after months of being put in an extended “timeout” by his communist overlords.

Investing in a communist nation riddled with systemic fraud and led by someone who is consolidating power by cracking down on profits isn’t exactly a one-way ticket to generating great returns, so it’s hard to feel bad for Perlmutter there.

It’s worth noting Perlmutter became more bullish on the Chinese company’s prospects after Biden’s election. It’s doubtful he would have made the same calculation had Trump prevailed.

Perlmutter’s purchase of Berkshire shares on June 16, however, appears much more suspect.

That’s because the very next week on June 24, the White House announced their support for the Senate’s bipartisan infrastructure bill framework.

Berkshire Hathaway stands to benefit tremendously from the infrastructure bill that’s now headed to Biden’s desk.

As the personal finance website the Motley Fool reported last April:

Spending of such epic proportions will be doled out a lot of different ways, but a great way to play the whole spending surge could be Warren Buffett’s Berkshire Hathaway. Railroad and transportation holdings feature prominently in Berkshire Hathaway’s portfolio of subsidiary businesses — including America’s largest railroad, BNSF, and privately held Pilot gas stations and big rig truck service stations. Manufacturing (like auto parts company Precision Castparts) is also a big piece of Berkshire. And there’s the company’s sprawling energy and utility business, which includes sizable holdings in renewable energy projects.

Did Perlmutter (or his wife, in this case) have advance knowledge of the Senate and White House’s infrastructure agreement last June? It certainly looks that way.

There is one final nugget in Perlmutter’s Periodic Transaction Report from this summer worth noting.

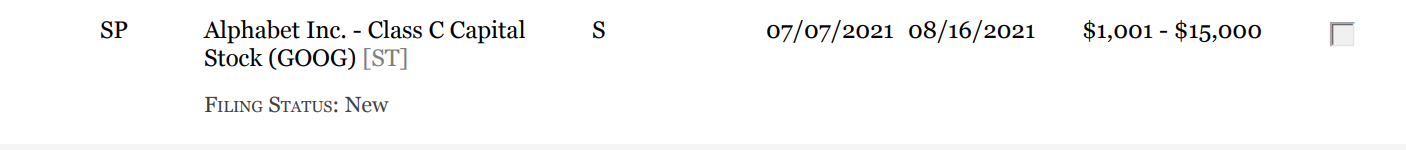

On July 6, we published a report on Perlmutter’s purchase of up to $15,000 of Alphabet (Google) stock in May of 2021, and his pattern generally of loading up on big tech companies that fall under the jurisdiction of the House Committee on Science, Space, and Technology.

That House panel, where Perlmutter sits in Congress, is keenly aware of yet-to-be-public legislative information impacting the tech sector.

Our report also discussed House Speaker and sci-fi gilded age villain Pelosi, who earned national scrutiny in June when it was revealed her husband exercised thousands of call options to purchase $5 million worth of Alphabet stock.

It appears Ed is an active Peak reader because the very next day, on July 7th, his wife completely unloaded their entire Google investment.

Bear in mind the Perlmutters only held their Alphabet shares for less than two months before deciding to sell on July 7.

What could have possibly changed? Nothing, besides the fact that Ed realized their May Alphabet purchase was barely a month removed from Pelosi’s $5 million windfall.

Additionally, a Bloomberg report that posted mere hours after the market close on July 7th revealed Pelosi’s husband netted $4.8 million in profits off of Alphabet options that he purchased prior to a key House Judiciary anti-trust vote.

Is it a coincidence that Perlmutter’s wife just happened to liquidate their Google shares on the same day Democrats realized their Alphabet investments were going to be a political problem?

Unfortunately for Perlmutter, the STOCK Act is the very law designed to detect this kind of potential malfeasance.

Thanks to the disclosure rules, voters now know Perlmutter dumped his big tech holdings after Peak reported on his penchant for trading tech companies that fall under the jurisdiction of his congressional committee.

If he’s embarrassed or simply got caught in his unethical attempt to profit off of his position in Congress, Perlmutter ought to explain to voters why.

As national Republicans’ newest target, we fully expect Perlmutter will have ample opportunity to explain why the STOCK Act is causing him so many problems.

Among the state’s congressional delegation, only Perlmutter and U.S. Sen. John Hickenlooper actively trade a wide range of individual stocks.

*EDITOR’S NOTE: In full disclosure, Business Insider is the same publication run by SCUMBAG SCUMBAG SCUMBAG CEO Henry Blodget, who is permanently banned by the SEC from trading securities.

Reminder I will go on any show that invites me on. I want to scream from the rooftops about what is happening here. This shouldn’t be political. Everybody should be outraged pic.twitter.com/MbGIk0SZGA

— Dave Portnoy (@stoolpresidente) November 9, 2021

In the interest of truth and transparency we independently verified Perlmutter’s trades reported by Business Insider, which can be accessed on the House Clerk’s website.