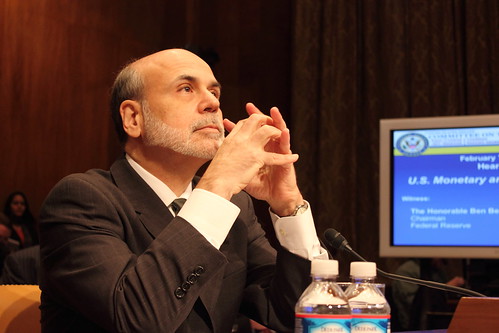

Last week, Ben Bernanke, the Chairman of the Federal Reserve, announced yet another round of stimulus, or quantitative easing, known as QE3. Quantitative easing is a measure of last resort to stimulate the economy, in which, in this particular case, the Fed has committed to buying $40 billion per month of mortgage-backed securities guaranteed by problem children Freddie and Fannie until the economy improves substantially. But, at what price? Critics of the policy, such as Michael Pento, founder of Pento Portfolio Strategies, have called it “the nuclear option for [the administration]” and “a never-ending weapon that is being fired at the middle class.”

According to a statement by the Fed, the purpose of this program is to “stimulate the economy by pushing up the value of assets like stocks and homes or refinance their mortgages and pump the savings back into the economy by spending it.”Most experts believe this round of funding will have little to no impact on housing demand as the low demand stems from a large contingent who can no longer qualify to purchase a home because of credit damaged by the economic downturn, joblessness, a lack of a downpayment, or the permanence to invest in a home.

Further, the idea that consumers would plow savings that result from access to cheaper debt is part of how we got here in the first place.

David Stockman, former budget director for President Ronald Reagan, echoed this concern in an interview with ZeroHedge:

“We’re doing all the wrong things. We’re adding to the problem, not subtracting. We are not allowing the debt to be worked down and liquidated. We’re not asking people to save more and consume less, which is what we really need to do. And so therefore I think policy is just making it worse, and any day now we will have another recurrence of the kind of economic crisis we had a few years ago.”

Even Bernanke doesn’t think his policy has the teeth to take a bite out of the chronic unemployment issue: “I want to be clear – while I think we can make a meaningful and significant contribution to reducing this problem, we can’t solve it. We don’t have tools that are strong enough to solve the unemployment problem.”

What QE3 will do is bolster stock prices and the prices of commodities, such as gold, silver, food, and oil, which means that the average American family will be paying more for basic necessities without a corresponding bump in pay. Further, QE3 will continue to hurt “savers” with near-zero interest rates and retirees who rely on fixed incomes and interest income.

The USA Today ed board noted:

“These complaints all have at least some legitimacy. But the Fed’s efforts at juicing the economy and producing jobs are the best available option at a time when Congress is actively depressing economic activity. By refusing to deal with the ‘fiscal cliff’ at the end of the year, when numerous spending cuts and tax hikes are set to go into effect at once, lawmakers are unnecessarily putting uncertainty in the minds of business leaders who otherwise might be hiring workers and investing in new equipment.”

Unfortunately, like many of the middle class households that will be hurt by this policy, the federal government is slowly reaching the end of its borrowing ability. The key to real economic growth doesn’t lie with government but outside of it. It certainly would be helpful if President Obama understood this.