U.S. Sen. John Hickenlooper’s investment in Facebook stock is drawing fresh scrutiny this week in the wake of a bombshell 60 Minutes report that alleged misconduct at the social media giant.

At this week’s Senate hearing with whistleblower Frances Haugen, Hickenlooper honed in on what impact potential changes to the company’s newsfeed algorithm could have on the company’s bottom line.

“What impact on Facebook’s bottom line would it have if the algorithm was changed to promote safety and to save the lives of young women rather than putting them at risk?” said Hickenlooper.

After Haugen answered that Facebook could still be profitable while doing more to protect women, the senator went on to speculate that perhaps the company could be more profitable if fewer people believed it was bad for their mental health. After this line of questioning, which never veered from a focus on Facebook’s bottom line, Hickenlooper yielded the floor.

Notably, Hickenlooper steered clear of asking Haugen about her broader allegations of misconduct at the company.

His interest in Facebook’s profits may not be entirely benign.

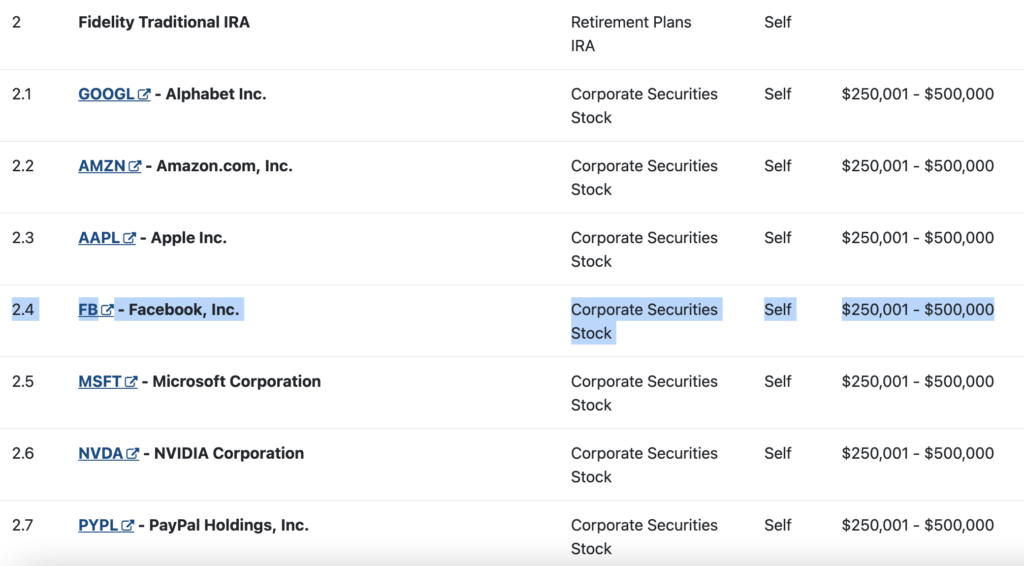

Colorado’s junior senator owns as much as $500,000 in Facebook stock, according to the latest Senate financial disclosures.

“According to a review of his financial disclosures, Hickenlooper currently owns Facebook stock worth $250,001 to $500,000, a fact first noted by congressional information services LegiStorm.” https://t.co/EcUaodbfDQ

— Christian Stafford (@Christian_Staff) October 5, 2021

The Facebook shares held by Hickenlooper are held in a retirement account that appears to be self-directed.

This is an important distinction because Hickenlooper’s IRA appears to consist of stocks he has personally invested in himself, not passively through a managed account or other funds that often contain a wide basket of stocks.

In other words, Hickenlooper has a direct financial interest in new regulations or changes at the company that could impact the tech giant’s profitability going forward.

Hickenlooper is famously conflict averse, but his narrow line of questioning at the hearing looks incredibly suspect in light of his hefty stake in the company.

Overall, Hickenlooper’s net worth totals at least $7.8 million.

Scrutiny of Hickenlooper’s Facebook stock is hardly the first investment to raise questions this year.

The senator’s wife, Robin Pringle, purchased shares of Peloton after the Consumer Product Safety Commission warned consumers to stop using the company’s treadmill around small children last spring.

Pringle also invested in CarGurus in February, a used car website whose business could be affected by decisions made by the Senate’s Committee on Commerce, Science, and Transportation, of which Hickenlooper is a voting member.

Hickenlooper and U.S. Rep. Ed Perlmutter are the only two members of Congress in Colorado who actively hold and trade a wide range of individual stocks.